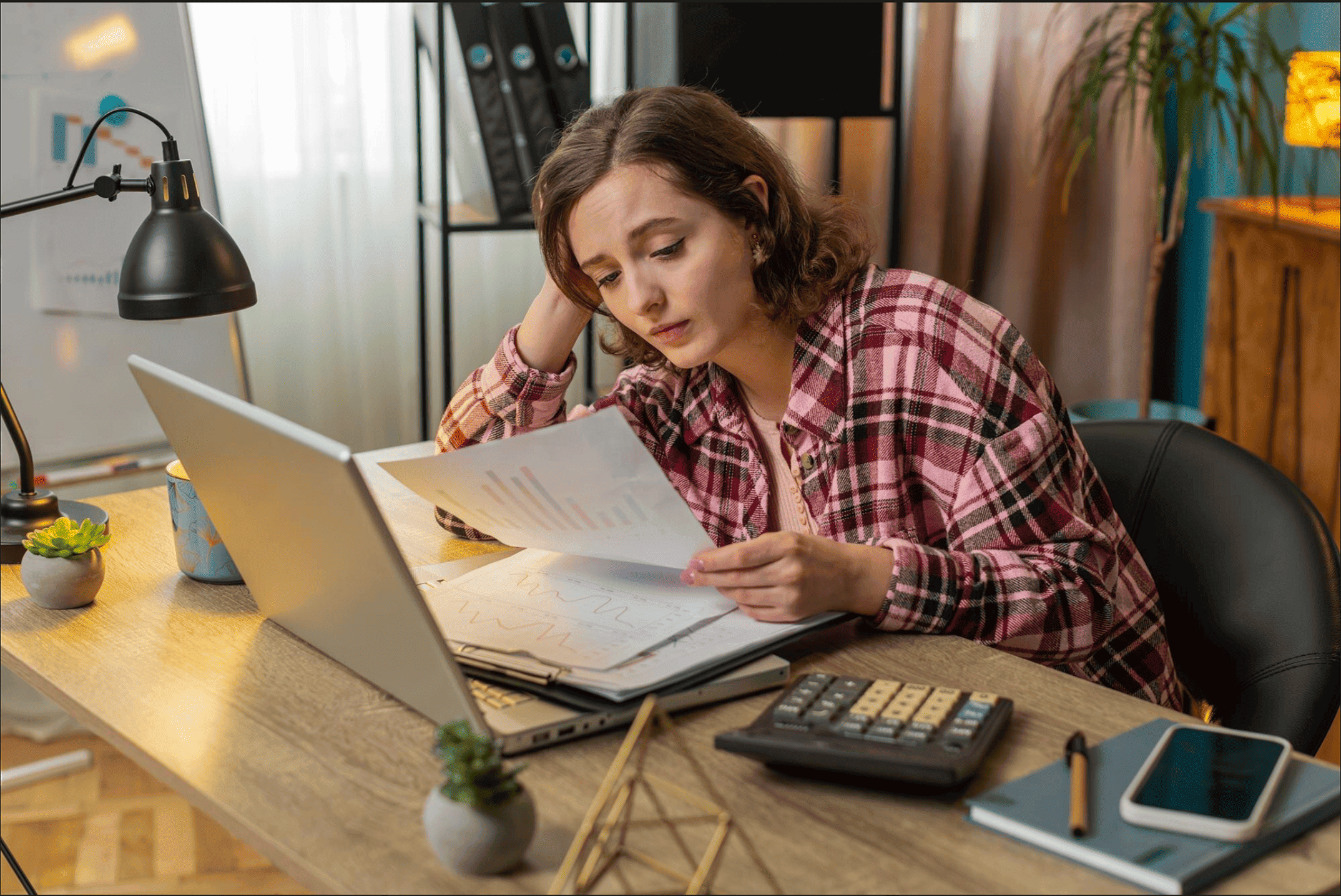

Tax Planning

Tax planning is the art of strategic financial decisions.

It's about optimizing your investments and expenses to

minimize tax liability and maximize savings.

.jpg)

The end of the financial year often brings stress and last-minute decisions. You might be focused on hurriedly making investments just to save on taxes, without considering your long-term goals. What you need is a smarter, more strategic way to approach your finances.

Move from a last-minute scramble to a year-round strategy.Build a proactive blueprint that uses smart, tax-efficient investment products to legally and effectively reduce your tax implications while building a strong financial future.

Did you Know?

According to a research paper on IJRAR.org, most Indian tax-payers wait until the last quarter, often making rushed and sub-optimal investment decisions. 57% are uncertain or lack sufficient knowledge of the tax deductions available.

Targeting tax efficiency through informed choices

Tax planning should be a year-round strategy, not a last-minute scramble in March. We provide information on tax-efficient investment avenues under current regulations, helping you understand how different asset classes impact your post-tax returns. By optimizing your portfolio for tax efficiency, we help ensure that more of your hard-earned money stays working for your long-term goals.

We believe tax planning should be a seamless part of your financial journey. Our process is designed to be clear and focused on your investment goals.

We start by understanding your current financial picture and longterm objectives. Our goal is to help you see your tax situation as part of your overall wealth-building journey, not just an annual task.

We help you strategically review your investment options. We 'll guide you through understanding how different tax-saving instruments fit into a comprehensive plan for asset allocation and capital gains

Once you have enough clarity, we help you invest in your chosen tax-saving products. It’s about putting your plan into action with confidence, so you can focus on what matters.

When you partner with us, rest assured

you are in highly capable hands.

Our team is registered and regulated by authorities like IRDAI, ensuring we operate with the highest standards of integrity.

Our team is well-qualified and experienced across all aspects of personal finance, from wealth creation to risk management.

We are fully aligned with your goals and interests, not with pushing random products. Because, our success is tied to yours.

We offer a non-judgmental space for your financial questions and concerns, because everyone deserves a partner who is both an expert and a guide.

Did you Know?

According to a research paper on IJRAR.org, 80%+ of Indian taxpayers never consult a professional. Complexity and shifting rules lead to missed deductions, mistaken filings, and under-utilisation of incentives.

Tax season doesn't have to be a source of stress. We help you find peace of mind by providing clarity on how you can reduce your tax burden strategically.

Move beyond the year-end scramble. Turn taxsaving from a chore into a disciplined, yearround habit, freeing you from end-of-financialyear panic.

Tax planning is not about avoiding taxes, it's about making smart decisions that not only reduce your tax liability but also build a powerful, long-term portfolio for your future

Every rupee saved because of efficient tax planning could go back into your investible corpus and in turn has the potential to compound into a significant amount over time.

Knowing the "what" and "why" behind your financial decisions gives you power. You’ll be empowered with a clear understanding of your plan, leaving no room for guesswork

It’s time to take Control

Let's have a conversation about your tax and financial goals. Our free clarity call is the perfect opportunity to discuss how you can make your money work harder for you.

Schedule my FREE Clarity Call

We’ll guide and support you though all

money moments and milestones.

Manage money better

Go on a Dream Vacation

Eliminate money stress

Educate your children

Change career or job

Trim and wipe out debt

Save and invest smarter

Buy your dream home

Everything You Need to Know