Retirement Planning

Retirement planning is your blueprint for financial freedom.

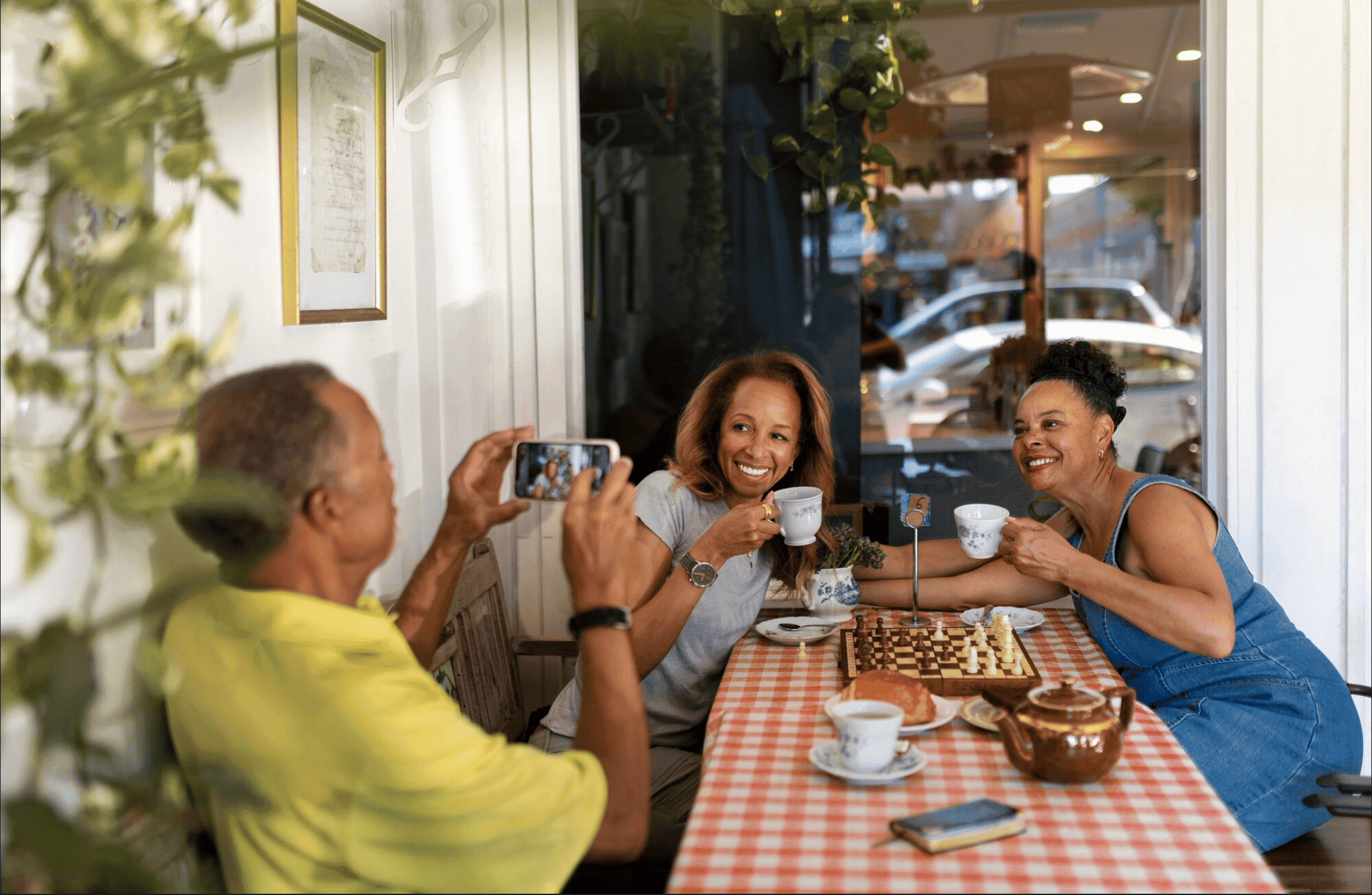

Envision a future where you can live life on your terms, free from

worry.

The fear of the future can feel overwhelming. The questions pile up: "Will I have enough to retire?" "What about inflation?" "How do I even begin?" We understand those worries, but they don't have to define your journey.

A great retirement isn't a matter of chance, it's a matter of design. You need to create a personalised blueprint for a future where you are in control. It's not just about money, it's about building a life you can look forward to.

Did you Know?

According to a Morningstar report, 9 out of 10 Indians aged 50+ wish they had started saving for retirement at a younger age. Meanwhile, 61% worry they will run out of savings within just 10 years of retiring.

Carving your path to financial independence

Preparing for retirement is about ensuring your lifestyle remains uninterrupted when your professional income stops. We help you quantify your future needs by accounting for inflation and longevity, providing the support required to build a robust corpus through disciplined monthly contributions. Our goal is to simplify the transition from earning to living on your accumulated wealth.

We believe a great plan starts with a great conversation. Here’s how we turn your vision into a reality.

We start by listening. Tell us about your ideal retirement, what does it look like, and when do you want it to begin? Your dreams are the focus and the foundation.

We guide you to craft a comprehensive strategy tailored to your unique goals. From investments to tax efficiency, you’ll have a roadmap that is clear, achievable, and built just for you.

Life changes. Your plan should too. We’ll be with you every step of the way, monitoring your progress and adapting your strategy as your life and the market evolve.

When you partner with us, rest assured

you are in highly capable hands.

Our team is registered and regulated by authorities like AMFI and SEBI, ensuring we operate with the highest standards of integrity.

Our team is well-qualified and experienced across all aspects of personal finance, from wealth creation to risk management.

We are fully aligned with your goals and interests, not with pushing random products. Because, our success is tied to yours.

We offer a non-judgmental space for your financial questions and concerns, because everyone deserves a partner who is both an expert and a guide.

Did you Know?

According to a Morningstar report, despite high aspirations, most looking for a post-retirement pension of over Rs 1 lakh every month, even as their savings amount towards retirement is a meagre 1-5 per cent of their income.

Don’t wait until it’s too late to start thinking about your retirement. Every year, every month, every rupee saved today brings you closer to the secure and fulfilling future you deserve.

Finding your retirement target can feel like a guessing game. Or even worse, you can find a lot of random numbers on the internet. Remember, your number is unique to you and based on your expenses and desired lifestyle.

Inflation can quietly erode the value of your savings over time. It’s a crucial factor to consider when planning for your retirement. Remember, always take into account the possibility of higher inflation for medical and education expenses.

It’s time to take Control

Let's have a conversation about your retirement goals. Our FREE clarity call is the perfect opportunity to discuss your vision and explore how you can build a personalised plan to achieve it.

Schedule my FREE Clarity Call

We’ll guide and support you though all

money moments and milestones.

Manage money better

Go on a Dream Vacation

Eliminate money stress

Educate your children

Change career or job

Trim and wipe out debt

Save and invest smarter

Buy your dream home

Everything You Need to Know