Education Savings

Education is the ultimate gift you can give your child.

Ensure their brightest future is always within reach, no matter the

cost.

The cost of education is on a constant rise whether it’s primary, secondary, higher secondary college fees. Without a dedicated investment plan, providing your child with the quality education they deserve can seem like a daunting challenge. Don’t let money be the cause of an unfulfilled dream

A great education isn’t a matter of luck, it’s a matter of foresight. We’ll help you to create a personalized savings and investment blueprint that secures your child’s future. It’s about building a strong financial foundation that guarantees them access to the best opportunities in India or abroad.

Did you Know?

According to a report by theworldgrad.com, Indian students pay over ₹1 crore for a 4-year degree including tuition fees, living expenses, visa fees, health insurance, airfare etc. based on the university, location, and lifestyle choices.

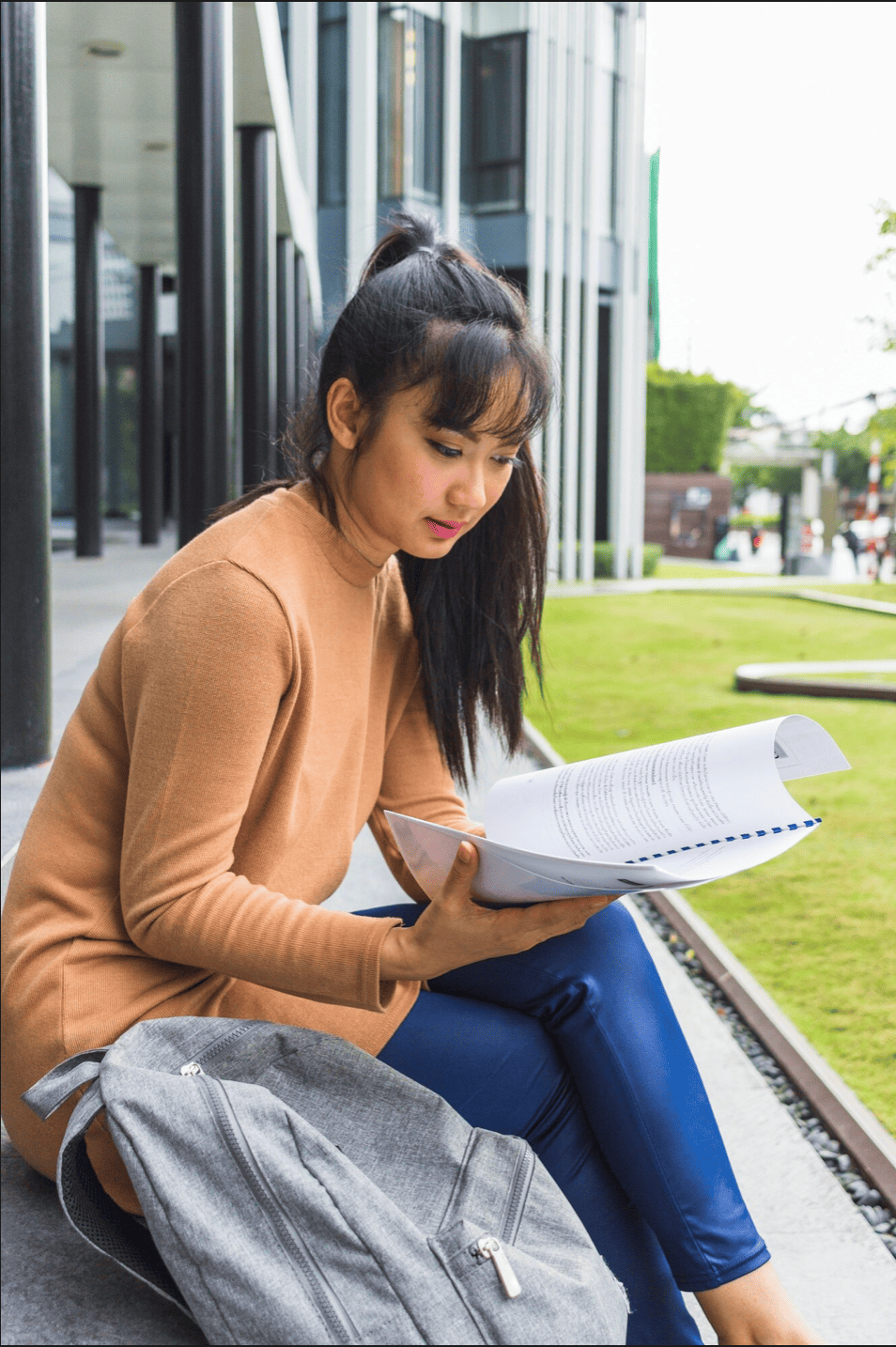

Investing in your next generation

With education inflation often outpacing general cost-of-living increases, starting early is the greatest advantage a parent can have. We help you estimate the future costs of higher education and facilitate the setup of goal-based portfolios that leverage the power of compounding. By creating a clear demarcation for these funds, we help you stay on track to meet your children’s academic milestones without compromising your other financial needs.

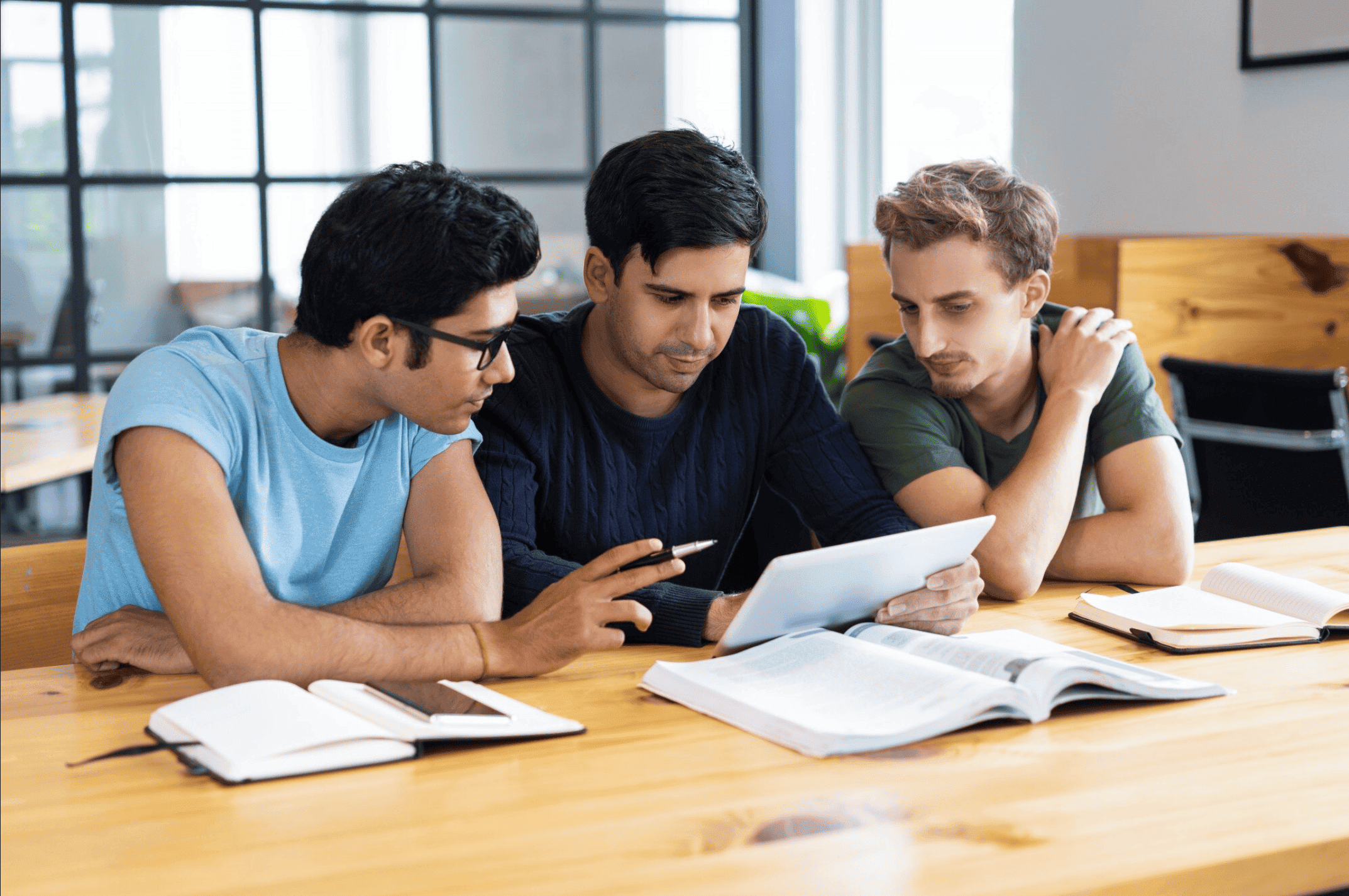

We believe a great education savings plan starts with a clear vision. Here’s how we turn that vision into a reality.

We start by understanding your goals. Tell us about your child's age, your target education milestone, and the kind of future you envision for them. This vision is going to be the roadmap.

We'll help you craft a comprehensive savings strategy. From consistent SIPs to smart lump-sum investments, we’ll guide you tobuild a plan that is designed to meet your target corpus and outpace inflation.

Your child’s journey is always evolving. We’ll be with you every step of the way, monitoring your savings progress and adapting your plan as your life and the market evolve.

When you partner with us, rest assured

you are in highly capable hands.

Our team is registered and regulated by authorities like AMFI and SEBI, ensuring we operate with the highest standards of integrity.

Our team is well-qualified and experienced across all aspects of personal finance, from wealth creation to risk management.

We are fully aligned with your goals and interests, not with pushing random products. Because, our success is tied to yours.

We offer a non-judgmental space for your financial questions and concerns, because everyone deserves a partner who is both an expert and a guide.

Did you Know?

According to a report by YourStory, in August 2022, the Reserve Bank of India (RBI) reported that the total student debt in India was a whopping Rs 145,785 crore (about $17.6 billion) and borrowers are having troubles repaying their loans.

Securing your child's education is a journey that requires foresight and confidence. We help you find peace of mind by providing clarity on two of the biggest challenges every parent faces.

Stop guessing and start planning. Knowing the approximate cost of your child's future education is the first step toward building a reliable savings strategy. Turn your dream into a specific, achievable goal.

The cost of education rises every year. You need to build a plan designed to ensure your savings don't just grow, but grow faster than inflation. With a smart strategy, you can protect your child's future from an invisible, rising challenge.

It’s time to take Control

Let's have a conversation about your child's future. Our free clarity call is the perfect opportunity to discuss your vision and explore how you can build a personalized plan to achieve it

Schedule my FREE Clarity Call

We’ll guide and support you though all

money moments and milestones.

Manage money better

Go on a Dream Vacation

Eliminate money stress

Educate your children

Change career or job

Trim and wipe out debt

Save and invest smarter

Buy your dream home

Everything You Need to Know