Insurance Planning

Insurance planning is your shield against life's uncertainties.

It's about ensuring your family's financial stability remains intact,

no matter what tomorrow.

The future is uncertain, and an unexpected illness or injury can derail even the best-laid financial plans. The weight of a sudden medical bill can be overwhelming, leaving you with difficult choices and long-term consequences. But it doesn 't have to be this way.

We help you build a comprehensive shield of protection. Insurance is not just a policy, it' s a safety net that protects your family, your income, and the savings you ' ve worked so hard to build. With the right plan, you can face life’s uncertainties with confidence.

Did you Know?

According to a Business Standard report, even among the urban, insured class, most families are only one major illness away from financial disaster due to insufficient coverage. Over 40 crore people are completely uninsured for health.

Building the foundation of your financial shield

Insurance is the bedrock of any sound financial plan, acting as a critical risk-transfer tool rather than an investment. We assist you in auditing your current cover to identify gaps in life and health protection, ensuring your family is shielded from the financial impact of unforeseen events. Our focus is on helping you secure adequate "pure protection" so your long-term investments remain untouched during a crisis.

We believe a good insurance planning starts with a clear understanding of your needs. Here’s how we help you find the right protection.

We start by listening. We 'll help you assess your health history, family size, and financial situation to understand your unique needs and risk tolerance.

We 'll guide you through a range of insurance products, explaining key features like coverage, deductibles, and premiums. Our goal is to empower you to make an informed choice.

We help you seamlessly secure the right policy. Our support doesn 't end there. We ' re with you for the long term, helping you with renewals and ensuring your coverage remains up-to-date.

When you partner with us, rest assured

you are in highly capable hands.

Our team is registered and regulated by authorities like IRDAI, ensuring we operate with the highest standards of integrity.

Our team is well-qualified and experienced across all aspects of personal finance, from wealth creation to risk management.

We are fully aligned with your goals and interests, not with pushing random products. Because, our success is tied to yours.

We offer a non-judgmental space for your financial questions and concerns, because everyone deserves a partner who is both an expert and a guide.

Did you Know?

According to a Business Standard report, Most people lack the needed cover to protect their dependents in case of premature death—especially acute among 26–35 year olds, where the gap exceeds 90%.

True financial freedom isn't just about growing your wealth; it's about protecting it. Insurance is the cornerstone of that security, and we help you build a comprehensive shield that provides complete peace of mind.

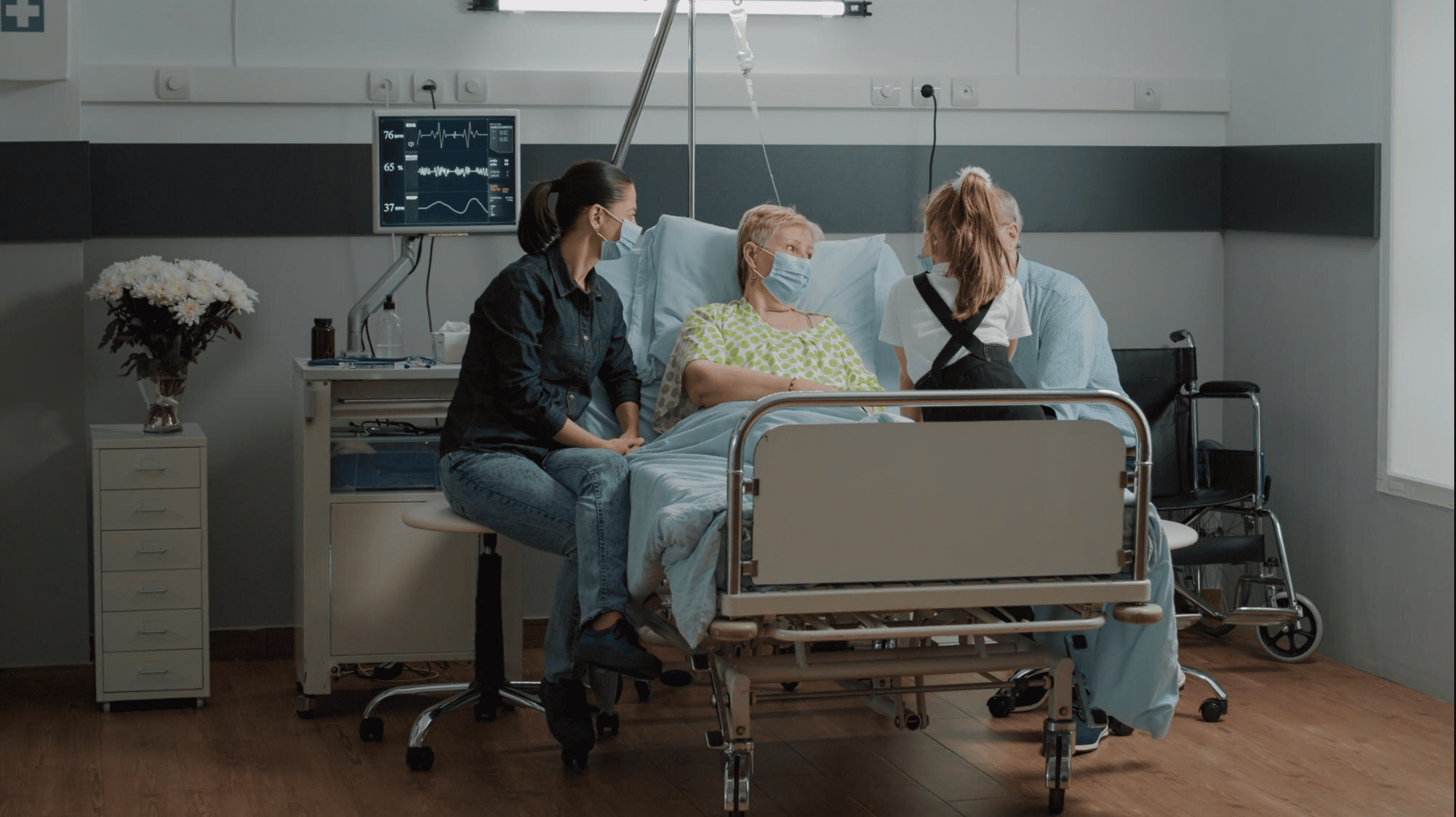

Protect your life's savings from the high costs of medical emergencies. With the right health plan, you can focus on recovery, not bills, knowing you have a financial shield against the uncertainties that may come your way.

A Life insurance term plan is a simple, powerful way to secure your family's financial future. In your absence, it ensures your loved ones can meet their financial goals and continue to live the life you've worked so hard to provide.

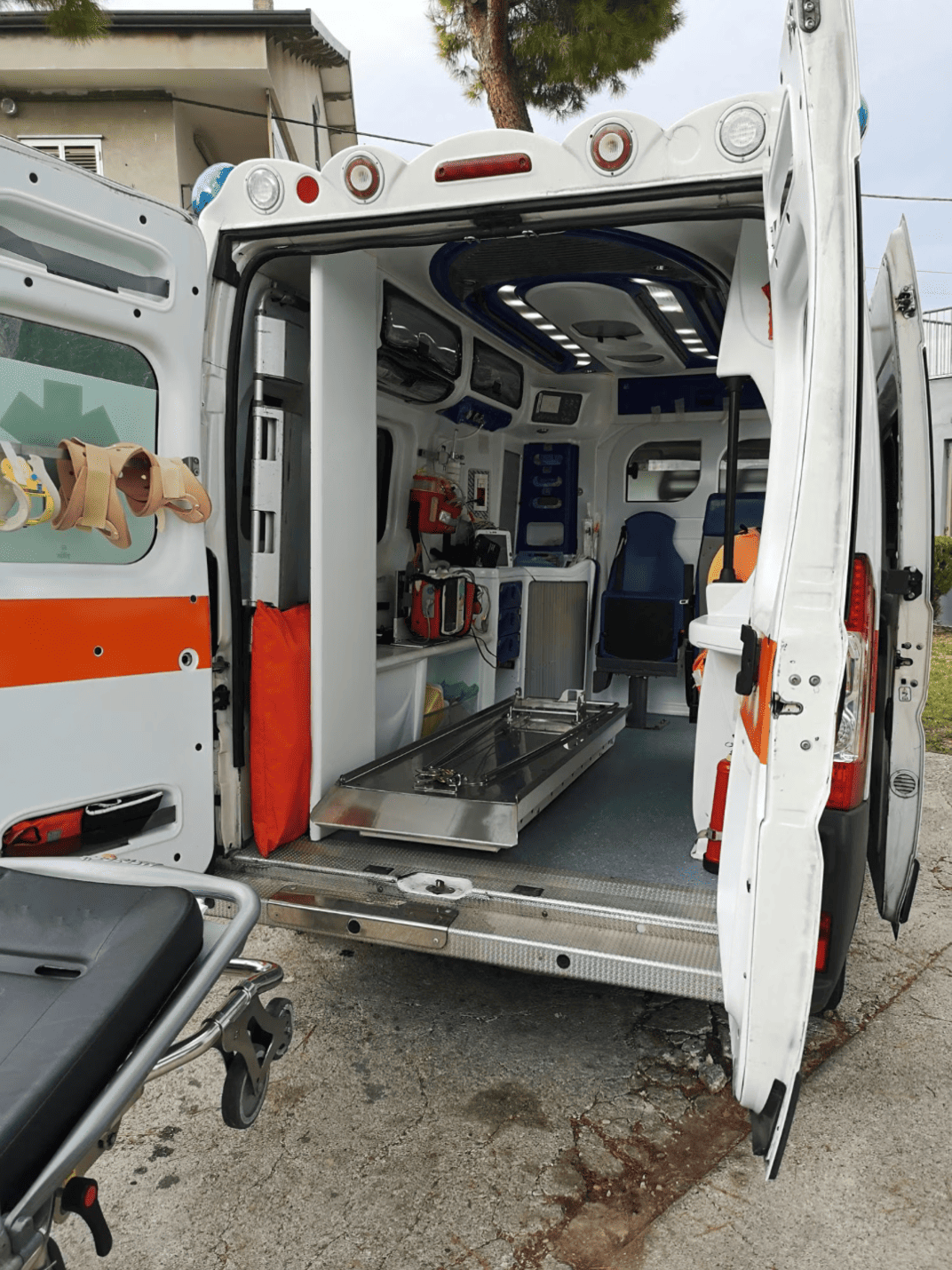

The road can be unpredictable, but your financial security doesn't have to be. A good motor insurance policy protects you from the financial burden of accidents, damages, and legal liabilities, so you can drive with confidence.

Explore the world without a worry. From lost luggage and flight cancellations to medical emergencies abroad, travel insurance provides a safety net that lets you focus on the experience, not the unexpected problems.

It’s time to take Control

Let's have a conversation about your insurance needs. Our free clarity call is the perfect opportunity to discuss your liabilities and explore how we can help you build a personalized plan that protects you

Schedule my FREE Clarity Call

We’ll guide and support you though all

money moments and milestones.

Manage money better

Go on a Dream Vacation

Eliminate money stress

Educate your children

Change career or job

Trim and wipe out debt

Save and invest smarter

Buy your dream home

Everything You Need to Know