Mutual Funds

Mutual funds provide a professionally managed, diversified portfolio.

Turn your small, regular savings into long-term compounded wealth.

With so many ads, reels and apps around, the world of investing can seem complex and intimidating. You might wonder which funds to choose, how much to invest, or how to navigate a volatile market. The fear of making a wrong decision can prevent you from taking the first step.

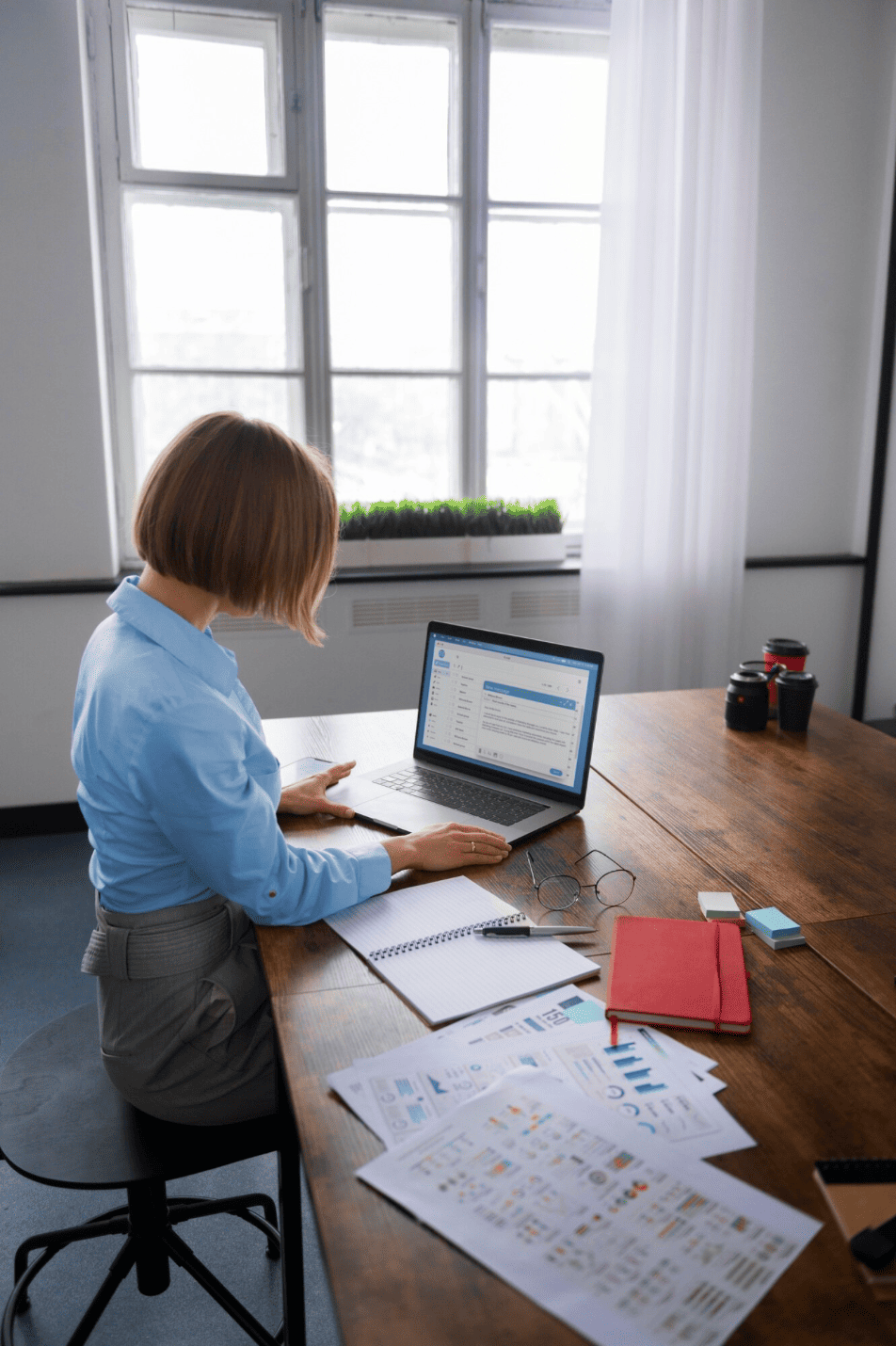

You need a clear, easy-to-follow blueprint for your investment journey. We empower you to make informed decisions and execute your investments with confidence. So you can make your money work for you in the background, while you continue to go about your business.

Did you Know?

According to a report by Jupiter Money, India is second to only US, with over $400 billion in assets under management and is one of the fastest-growing markets in the world, with a CAGR growth of 17.5% over the past five years.

A quick overview of mutual funds and how to invest in them.

Investing in Mutual funds shouldn't feel overwhelming. It should be straightforward and accessible, even if you're new to investing. We offer access to a wide variety of funds, a simplified investment process, and the ongoing support you need to navigate your financial journey with confidence.

We believe investing should be accessible to everyone. Our approach is designed to be clear and transparent from start to finish.

Before you begin, it’s important to understand your own financial comfort zone. Assess your risk tolerance and understand how it aligns with your investment goals

Begin to build a portfolio that reflects your risk profile and goals. Explore and choose from a wide range of funds, helping you create a diversified portfolio that spreads risk across different assets and market segments.

Your investment journey is a continuous process. Our reports and app provide a clear view of your portfolio's performance, allowing you to track your growth in real time and stay in control, always.

When you partner with us, rest assured

you are in highly capable hands.

Our team is registered and regulated by authorities like AMFI and SEBI, ensuring we operate with the highest standards of integrity.

Our team is well-qualified and experienced across all aspects of personal finance, from wealth creation to risk management.

We are fully aligned with your goals and interests, not with pushing random products. Because, our success is tied to yours.

We offer a non-judgmental space for your financial questions and concerns, because everyone deserves a partner who is both an expert and a guide.

Did you Know?

According to a report by AMFI, Systematic Investment Plans collected ₹28,464 crore in July 2025 alone and surpassed ₹1.62 lakh crore in the first half of 2025, illustrating the steady, disciplined investment approach of Indians.

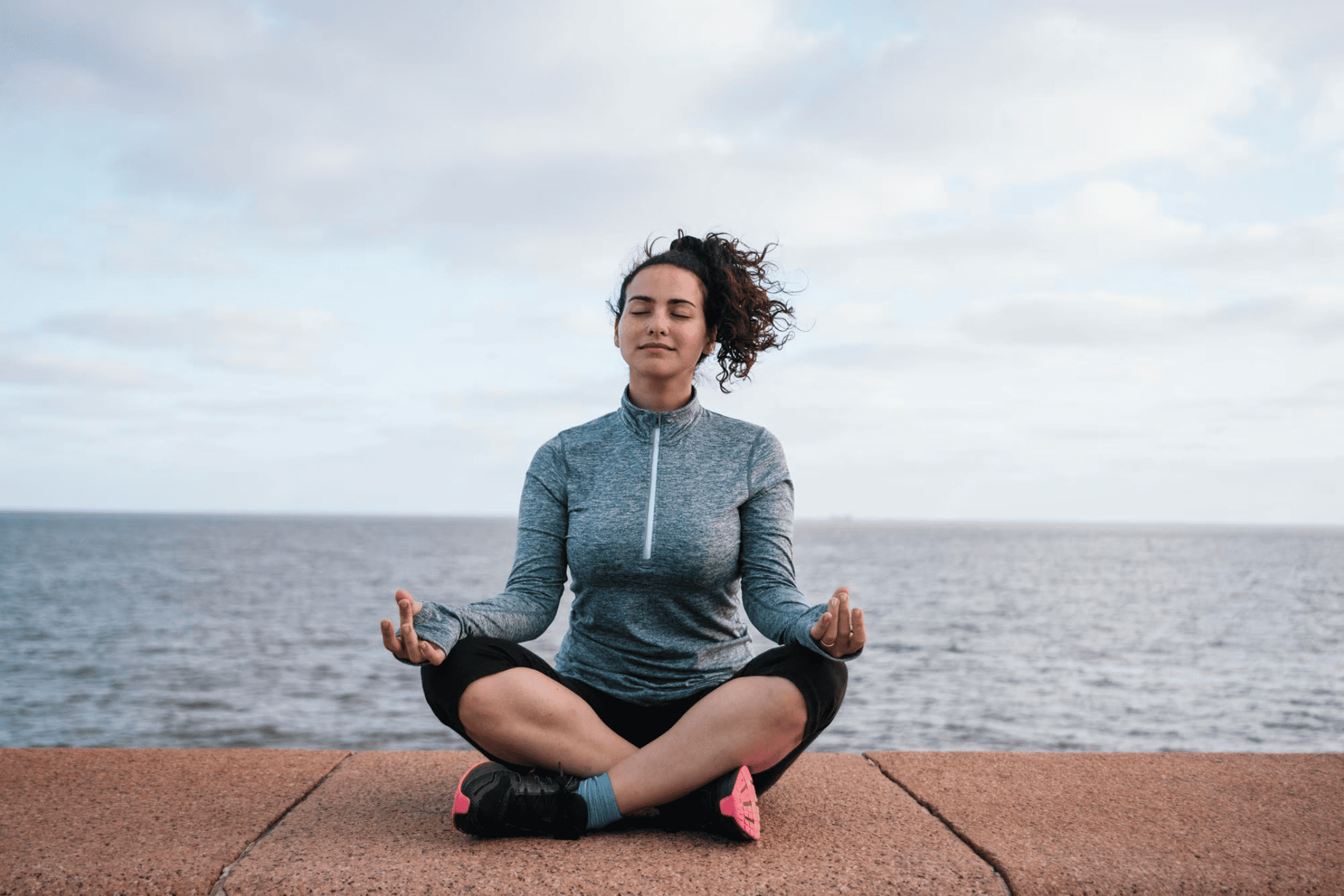

Investing in mutual funds can feel intimidating, but it doesn't have to be. We help you find peace of mind by providing clarity on the core benefits that come with this investment vehicle.

Your money is managed by experienced fund managers who research and select securities for your portfolio. This expertise helps you navigate market complexities without needing to be an expert yourself.

A mutual fund invests in a basket of securities, automatically spreading your risk across different assets and sectors. This strategy helps to reduce the impact of a poor performance by any single investment.

Mutual funds offer a cost-effective way to access professional management. The expense ratio i.e. management costs are typically much lower than many other investment options such as portfolio management services (PMS).

A Systematic Investment Plan allows you to invest a fixed amount regularly, helping you build discipline and benefit from rupee cost averaging. It turns small, consistent contributions into a powerful long-term wealth-building habit.

You can easily redeem (liquidate) units of open ended mutual fund schemes to meet your financial needs on any business day (when the stock markets and/or banks are open), so you have easy access to your money.

Investment in ELSS mutual funds upto ₹1,50,000 annually qualifies for tax benefit under section 80C of the Income Tax Act, 1961. Mutual Fund investments when held for a longer term are tax efficient compared to others like FDs,

It’s time to take Control

Let's have a conversation about your investment goals. Our free clarity call is the perfect opportunity to discuss your vision and explore how we can help you build a personalized plan to achieve it.

Schedule my FREE Clarity Call

We’ll guide and support you though all

money moments and milestones.

Manage money better

Go on a Dream Vacation

Eliminate money stress

Educate your children

Change career or job

Trim and wipe out debt

Save and invest smarter

Buy your dream home

Everything You Need to Know